In the intricate landscape of education, discussions about personal finances predominantly revolve around comprehensive financial planning. Yet, within this realm, one often underestimated facet stands out—the humble teacher’s paycheck. For a deeper understanding of the nuances of pay stubs, and for more information on financial management, read here. These resources can provide supplementary insights and guidance to complement the unraveling of the teacher paycheck mystery. But let’s explore the paychecks.

Decoding Your Paycheck

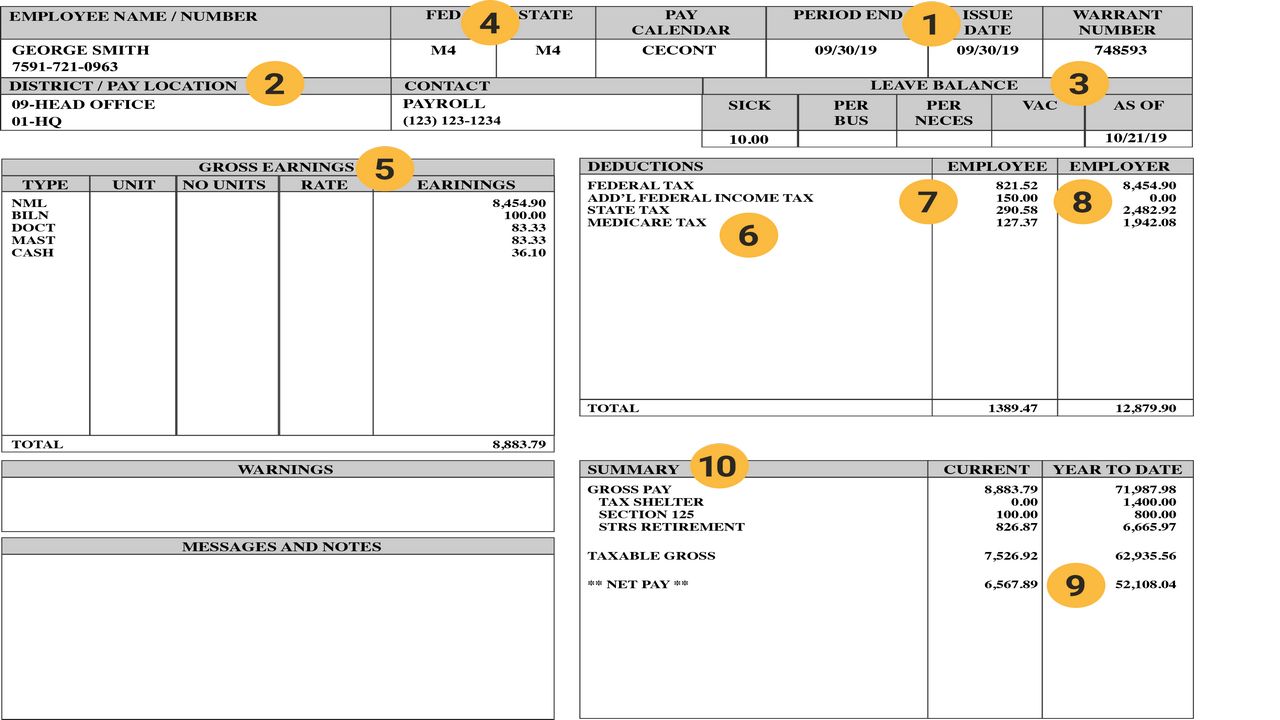

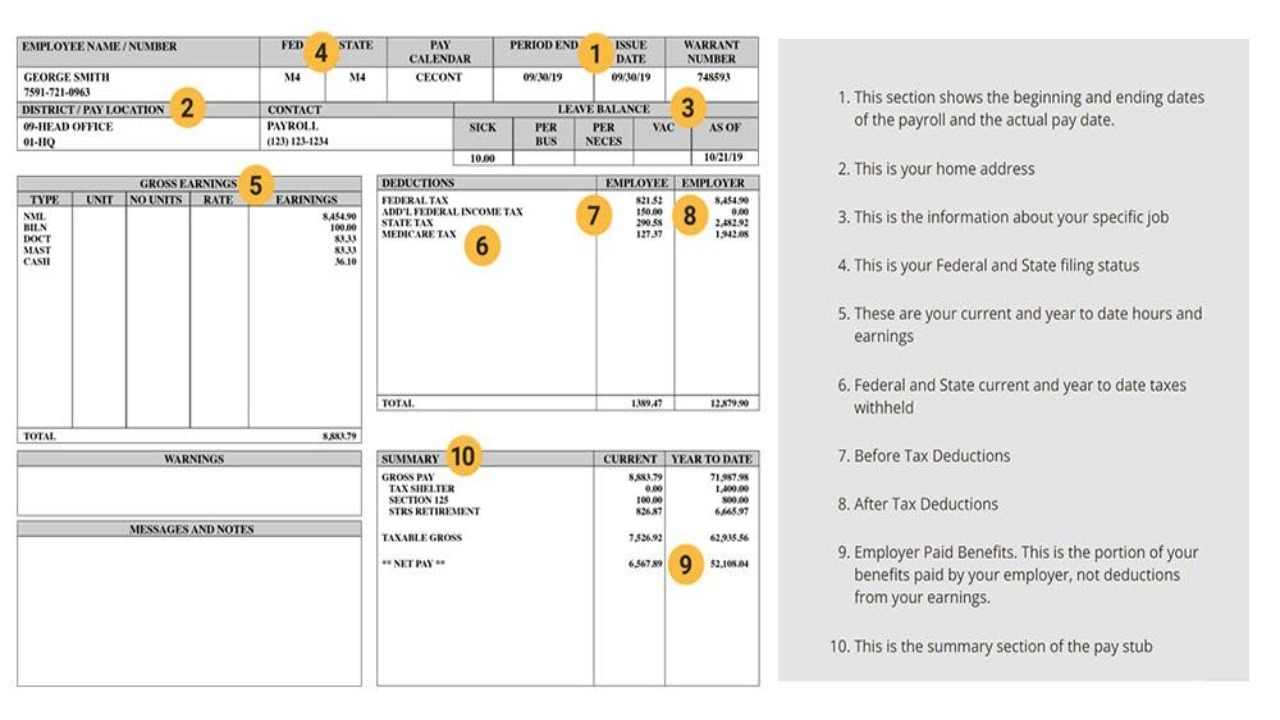

Teacher paychecks exhibit diversity not only across the country but even within different districts. While the appearance may vary, certain commonalities persist. For instance, consider the paycheck from an Illinois district, a representative example that provides insights applicable to many. The document typically comprises three main sections.

Earnings Breakdown

The initial section delineates the payment details beyond the contractual obligations. It displays the current pay and the year-to-date pay, ensuring accuracy and consistency across pay periods.

Employee-Paid Deductions

The middle section unveils a list of deductions shouldered by the employee each pay period. Acronyms like TRS may populate this section, providing a snapshot of the financial commitments. For those contributing to retirement plans outside the workplace, this section is where you usually find details about 403(b) contributions.

Employer-Paid Deductions

The final section sheds light on the contributions made by the employer, encompassing coverages and pension plans. While this section may not directly impact the overall pay, it provides valuable insights into the employer’s financial involvement.

Understanding the Acronyms

Navigating the sea of acronyms on a teacher’s paycheck can be challenging. Here’s a quick reference guide to some common categories:

Gross Pay: Pay before any deductions or reductions.

Pre Fed Tax: Payment of benefit items before Federal taxes.

Fed Tax: Payment of Federal Taxes.

Sta Tax: Payment of State Taxes.

Soc Sec: Payment of Social Security and/or Medicare (Note: Many teachers are exempt from Social Security).

Oth Ded: Payment of other deductions, leading to the net pay deposited into your bank account.

LOC: Location (e.g., HMS for Highland Middle School).

MAR-S: Marital Status for payroll purposes (e.g., “S-Single” or “Fed/Sta” for Federal and State exemptions/withholding).

Relating Your Paycheck to Your Finances

Understanding your paycheck is not merely an exercise in decoding. It’s a crucial tool for financial planning. Annually, you’ll need information from your paycheck for your accountant, detailing 403(b) savings, dues paid, and adjustments based on exemptions. Auditing your paycheck for accuracy is essential, as errors may persist, impacting your financial records.

In conclusion, the teacher’s paycheck, often adorned with cryptic codes, is a financial roadmap. Regular audits and a grasp of the acronyms embedded within empower educators to ensure financial accuracy. If you have questions about your teacher’s paycheck, feel free to leave them in the comments, and we’ll address them in future posts. Happy financial navigating!